Grocery, pharmacy, and household items are critical segments in the US retail industry, and the current outbreak of COVID-19 disease caused by the novel coronavirus SARS-CoV-2 is leading to shifts in the supply chains that provide these goods to consumers. Let’s think about the prospects for the expansion of the e-commerce sales channel for these segments.

A number of abrupt changes in our economic lives may require rapid and effective response by the firms that supply grocery, pharmacy, and household items. We see growing demand for items that consumers use to combat the virus. Social distancing policies, quarantines, and shelter-in-place directives have resulted in more of us staying in and around our homes more hours of the day. So we also see increased demand for preparing meals and eating at home, and greater consumption rates for other household items like soap and other cleaning products, paper towels, and yes, toilet paper. By now we’ve all witnessed empty shelves where the paper products used to be, like those in my photo from Atlanta above!

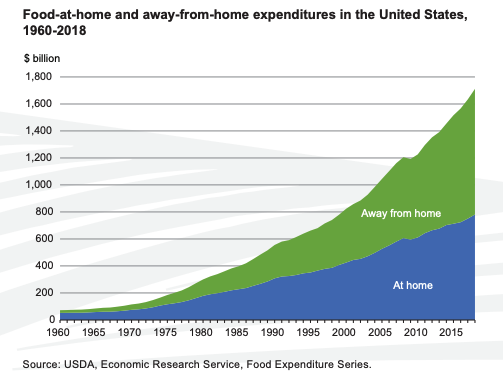

You may be a bit surprised to learn how much food eaten by US consumers is not usually prepared in the home. Nearly $1.7 trillion was spent on food by consumers in the US in 2018, and $900 billion of that spend occurred for food consumed outside of the home. Of course, this does not mean that we satisfy over half of their nutritional needs this way. Prices per calorie are generally higher when you are eating out. Note also that outside-the-home expenditures include all the spend by international travelers eating out during visits to the US. Dramatic reductions in eating out will strain the US restaurant economy. Will restaurants be able to survive a long period of decreased demand by ramping up curbside pickup? Will delivery services like Grubhub and Doordash be able to safely accommodate growing demand for meal delivery? It’s not clear. What seems certain, however, is that retail food supply chains will need to rapidly reconfigure if significantly more home meal preparation and consumption occurs in the short and medium term. If shoppers find it inconvenient or unsafe to visit retail stores, e-commerce for grocery and household items will need to grow as an alternative.

To understand more about how food supply chains may reconfigure in the coming weeks and months, let’s look at the current landscape. There are two types of food supply chains: food service and food retail. Food service supply chains serve the diverse restaurant industry. Large wholesale providers like Sysco and US Foods provide both foods and related products primarily to independent restaurants. Chain restaurant franchisees are more typically served by dedicated supply chains run by 3PL partners. Local areas also typically have fresh meats and produce suppliers that provide these products directly to independent restaurants. And of course, branded beverages like soft drinks and alcohol are delivered directly by yet other distributors.

Food service right now is experiencing a massive demand shock to the downside. Companies in this space recognize the challenge, and there is evidence that some supply chains are already reconfiguring somewhat in response to drying-up restaurant sales. Some food service supply chain firms may now start to also resupply retail stores. Some providers of meats and produce are also now introducing home deliveries. While the scale of such operations is likely to be limited, these providers typically have the temperature-controlled trucks and vans required to make home deliveries practical; remember that they already make direct deliveries to restaurants and multiple-stop delivery routes visiting consumer homes may not be much more difficult to plan and operate. Thinking about the larger firms like Sysco, I have not heard much news about how they may change their strategy going forward but you can bet the leaders at companies in this space are scrambling and looking for good ideas.

Now let’s focus on food retail, where supply chains are configured for delivery of products directly to consumers without a restaurant providing the preparation. Let’s focus on large grocery (like Kroger and Publix) and big-box retailers (like Walmart and Target). In the US, food retail is still largely a business where consumers are expected to travel to a store to view products, make purchases, and then transport them home. Groceries compete primarily on price for common brand items, and then on the quality/price tradeoff on fresh produce, meats, and prepared foods. Marketing for fresh foods focuses on getting consumers into stores, and then winning them over with quality products and effective in-store merchandising strategies that get these items into shopping carts for purchases. Shelf-stable foods include both major name brands and so-called private label brands, which are produced typically by the retailer or by exclusive partners. Selection of shelf-stable products and quality of private label draw consumers to specific retailers, while price competition is also critical for name-brand products where most stores carry a similar product mix. Finally, since consumers tend to make one or more retail store grocery shopping trips each week, grocery retailers have long been suppliers of other household staples to consumers: cleaning supplies, personal care items, paper products, etc.

E-commerce is exploding during the global COVID-19 crisis. Even in locations where retail stores are open for business, e-commerce is perceived (correctly) as a safer alternative to in-store shopping. Of course, no grocery e-commerce platform currently allows consumers to see specific items or packages of (particularly fresh) foods before making a purchase. Nonetheless, what are the prospects for growing e-commerce and home delivery of food and household items typically purchased at grocery stores? This is a complicated question to answer since it is difficult to replicate the grocery store trip cost-effectively using e-commerce with a one-size-fits-all strategy.

What seems easiest and likely to grow most quickly is a pickup-from-store model, like the Target Drive Up service. Under this model, the consumer places an order for items with an e-commerce platform, and then store associates do the shopping/order picking. Once an order is ready, the consumer travels to the store for pickup. Under such a model, the retailer keeps store traffic low and insulates its associates somewhat from customers with unknown health conditions. Additionally, since consumers use their own transportation for the last-mile delivery of product back to their homes, critical home delivery transportation issues are avoided namely synchronous delivery scheduling, temperature control for frozen and fresh foods, and packaging and vehicle space requirements for bulky household goods items.

Another model that may grow, but has a few more challenges, is the shopping-and-delivery service like that offered by Instacart; this company is currently awash in new demand. Instacart operates with a distributed pick-from-stores model, relying on third-party shoppers to head out to retail grocery stores to fill your order; another company that operates this way is Shipt but it provides delivery only from Target stores. Unlike the consumer pickup model, these delivery services have to manage home delivery scheduling; interestingly, this is less of challenge right now than usual since consumers are spending much more time at home. However, since third-party shoppers do not report each day to a store, it is more difficult for a firm like Instacart to monitor their health and thus consumers may be more skeptical of this approach as a safe option right now.

There are a few other major drawbacks of both of these models currently. One important one is that currently in the US in-store inventories are not well-tracked in grocery retail. If you place an order with either a pickup-from-store or third-party-shopper service, it is not guaranteed to be inventory when your shopper or associate goes to pick it from the shelf for you. This does not happen in (best-of-breed) distribution centers, where inventory levels can be decremented as soon as an order is accepted and before it is picked! In the absence of better systems, Instacart relies on machine learning to help you avoid adding items to your order that are likely to be out-of-stock. During low or normal volume sales periods, this approach can work well since stores do a good job predicting demand and maintaining inventory availability. However, it may not work so well when demand is high or otherwise harder to predict.

What other models might work well for grocery e-commerce? Of course, e-commerce giant Amazon provides services in this space. Interestingly, the diversity of its offerings demonstrates that there is not yet a good one-size-fits-all approach to serve demand. Currently, you can order smaller household goods and shelf-stable foods through the usual Amazon fulfillment center (FC) network. Many household goods are bulky, however, and Amazon runs a separate service called Subscribe and Save where they encourage regular shipments with a discount for items like paper products, detergents, pet foods, etc. Amazon Fresh is a grocery delivery service that operates using picking from local distribution centers, and the focus here is fresh and frozen items, shelf stable foods, and less bulky household goods. Finally, Amazon also offers a pick-from-store model for Whole Foods orders. Of these models, Amazon Fresh has a potential advantage over Instacart given better real-time inventory availability; furthermore, growing integration with Whole Foods will allow Amazon to increase its private label fresh, frozen, and shelf-stable food availability through Amazon Fresh. To make deliveries quickly, however, separate Amazon Fresh distribution centers are required in areas with appropriate customer density so this model won’t work everywhere. Will we see a scale up of Amazon Fresh and Whole Foods delivery during the COVID-19 outbreak? I would imagine they are working hard at this right now. We do know that Amazon is ramping up capacity and changing its product mix in the short term, but it is difficult at this point to uncover its strategy for different segments of its business.

Rapid changes in the ways consumers get food are happening during the COVID-19 outbreak, and it remains to be seen which of these are short term and which will last. It seems quite likely, though, that we will see significant growth in e-commerce fulfillment in grocery and household goods retail.